How Do You Know Market Price of Home

Tabular array of contents

- Offset with online valuation tools

- What online value estimators tell you

- Pros of online valuations

- Cons of online valuations

- Piece of work with your realtor

- How realtors determine home values

- Comparative market analysis

- Broker toll opinion

- Get a professional appraisal

- What an appraiser does to determine a dwelling's value

- Price of hiring an appraiser

- Pros and cons of professional appraisals

- Create your own comps

- Belongings comparison tools

- What to expect for

- Key takeaways

- Explainer: Appraised vs fair market vs assessed value

- Helpful home valuation tools and links

If you're thinking of selling your home, then you've probably wondered How much can I sell my home for? One of the challenges of determining your home'due south value is that "value" is subjective; ane buyer may be willing to pay more than another. So how exercise you observe that sweet spot, meaning a listing price that volition attract buyers and help you reach your goals?

The more than you know nearly the factors that influence value, the easier it is to found realistic expectations for listing and selling. Some of the most of import factors include:

- Dwelling size and age

- Location and local market weather

- Comparable homes that have sold recently

- Economic weather, including interest rate surround

- Renovations and repairs

This guide breaks down everything you lot need to know nigh the about constructive ways to determine the value of your domicile equally you become ready to sell.

1. Start with online valuation tools

Online home value calculators use the information you provide well-nigh your home, along with information gleaned from public records, to calculate an estimated value of the holding. They're a uncomplicated and convenient manner to get a ballpark idea of what your domicile might exist worth.

For example, PennyMac'south value estimator takes the address of your home and returns an judge of the overall value, toll per foursquare foot, property details, sales history, and value history.

If yous desire more than than just an estimate, request an offer from us at any time; it'south gratis and in that location'due south no obligation to have. Larn more virtually how we calculate the value of your home.

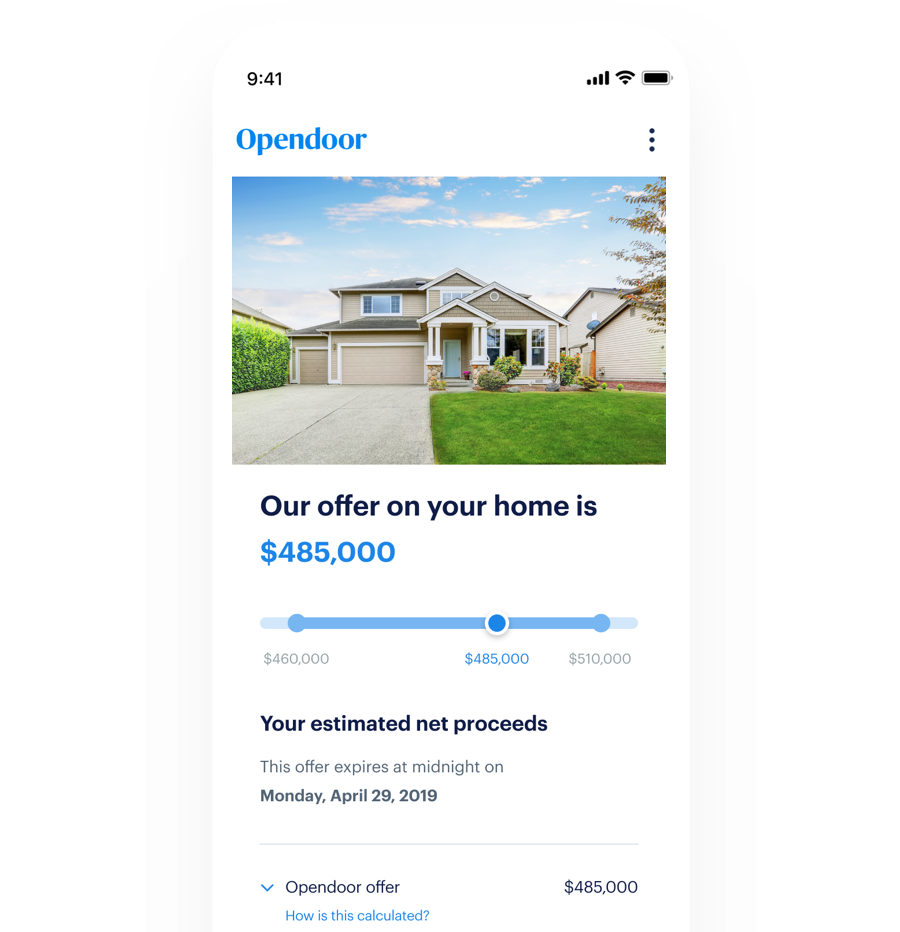

Case of an Opendoor offer.

Case of an Opendoor offer.

Pros of online valuation tools:

- Nigh are free and piece of cake to utilise.

- They tin rapidly requite you an guess of your domicile's value, often without having to provide a lot of info virtually your dwelling house.

- Many valuation tools update regularly, which is useful if you lot demand to tweak your list price during the selling procedure.

Cons of online valuation tools:

- These tools are designed to provide an guess and may non take into business relationship unique aspects of your dwelling that appeal or don't entreatment to buyers.

- Valuations can vary from one tool to the adjacent, depending on which factors the tool uses to determine value.

- These tools generally don't have into account things like renovations or repairs, which can significantly influence your home's value.

2. Work with a realtor

Realtors have their ain techniques for determining a home's value, and it can exist helpful to get a 2nd opinion to go along with the estimates from an online valuation tool. The process many realtors use to judge a home'south value is called a Comparative Market Analysis (CMA).

How practise you find that sweet spot – a listing price that will concenter buyers and aid you reach your goals?

A CMA includes information about comparable homes (also known as "comps") in your area. According to Nolo, a skillful CMA can tell you what homes similar to yours are selling for, how long it'due south taking them to sell, and what homes sold for compared to their original listing toll.

When working upward a CMA, realtors typically look for recently sold homes that are like in:

- Size

- Location

- Number of bedrooms/bathrooms

- Way and view

- Abode blazon (east.g. single-family domicile, condo, townhome, etc.)

- Recent sales price

In preparing a CMA, realtors oft look at data from the local Multiple Listing Service (MLS). Information technology's a database of backdrop in a given surface area that are listed for sale or have a sale pending.

In your quest to determine your abode's value, another tool you might come across is the Broker Price Stance (BPO). In some states, you need a license to provide one, whereas you don't for a CMA. The Appraisal Institute maintains information on land BPO laws.

BPOs are often briefer than a CMA and are more ofttimes used for brusque sale or foreclosure situations instead of for regular home sales. They are also slightly more than likely to cost coin vs. being free.

Keep in mind that a CMA or a BPO can still miss the mark on your home'south value considering they may not accept into account every feature of the property that affects value. That'southward something you lot tin address by following the adjacent step in this guide.

3. Hire a professional person appraiser

When someone'due south ownership a dwelling, the bank requires them to get an appraisal at some betoken before underwriting of the loan can be completed. Every bit the seller, y'all're not required to go an appraisal but it may exist a good idea if you don't want there to be whatever second-guessing about your home'south value when you lot're prepare to list.

It'due south the appraiser's chore to provide an impartial, thoroughly researched estimate of a abode'south value. They do that past visiting the property and reviewing recently sold or pending sale comps.

→ Desire to have the certainty of receiving a competitive offer and move on your ain timeline? Learn how we make selling your home easier.

Appraisers may use Fannie Mae's Uniform Residential Appraisement Study equally a guide for conducting an appraisement. This report is basically a checklist of things appraisers should look for, such as:

- Where the home is located

- Whether the home is in a FEMA flood zone

- The condition of the utility services and fixtures on the belongings

- When the home was built

- The blazon of foundation

- The condition of the attic and basement, heating and air systems, walls, windows and doors

- Whether the home has any amenities, such as a pool, deck or fireplace

- Whatsoever structural improvements or repairs that have been made

- Whether whatever additional repairs or improvements are needed

- The condition of any appliances in the home

- Signs of damage that would compromise the structural soundness of the home.

Using this report as a guideline, an appraiser would as well consider the sales history of the home and the approximate replacement cost to rebuild the abode.

An appraisal shouldn't exist dislocated with the home inspection, which focuses on whether the holding is structurally audio enough for a sale to be completed.

Cost of hiring a real manor appraiser

If you lot're thinking of hiring an appraiser to approximate your home's value, you'll desire to first brand certain the person you cull meets all the requirements of the Appraisement Qualifications Board (AQB). They should also have experience appraising your type of holding, ideally in your local market place. It may also be helpful to become multiple quotes. How much you'll pay for an appraiser depends on:

- Where you live

- The size of your dwelling

Generally, the bigger your home and the more things an appraiser has to examine to decide the value, the higher the price of the appraisal.

According to HomeAdvisor, you may pay anywhere from $250 to $450 for a dwelling house appraisement, with $332 representing the national average. Fixr puts the average price at $300 to $400, while Thumbtack lists the average appraisal price at $350 to $380.

Lesser line, you'll probable pay a few hundred dollars to have a home appraisal carried out. Then is it worth it to spring for an appraisal as y'all're preparing your home to sell?

Pros of getting a seller appraisement

- An appraisal tin can dorsum up the inquiry you've already done with online valuation tools or a realtor's CMA.

- Your appraisal could aid annul a low appraisal from a heir-apparent.

- It may yield some ideas for repairs or improvements you tin can brand alee of the sale to increase your home's value.

Cons of getting a seller appraisal

- It's money out of pocket you'll take to spend, and the buyer notwithstanding has to get their own appraisal.

- A valuation that'due south below what you initially expected could make determining a list toll more difficult.

- Appraisals are based on a fixed point in time so it's possible that by the time you're fix to sell, it could be out of date.

Getting an appraisal on acme of a CMA or BPO can give you a well-rounded picture of your dwelling's value. If the appraisement aligns closely with the CMA or BPO, that can help you be more confident in choosing a list price, but keep in listen, there are no guarantees you can sell your dwelling house based on these measures.

4. Analyze your own comps

Yous might not accept access to the MLS, but yous can still use some of the aforementioned factors to compare your house to similar ones selling in your surface area, including:

- Structural components and features

- Historic period and size

- Sales history

- Any upgrades or improvements

- Overall condition of the dwelling

- Neighborhood and location

- Listing price vs. actual sale price

You lot do, however, have to remember to account for differences between your dwelling house and comps that could affect value.

For instance, a home in your neighborhood that recently sold might be very like yours but it has a pool, where your home doesn't. You'd so have to determine the value of the pool and subtract that from the estimated value y'all came up with for your dwelling, based on the comp.

Online comparison tools

In that location are lots of tools and websites you can employ to evaluate your own comps. Here are some of the ones you lot might desire to consider as y'all put together your list:

- Realtor.com'southward But Sold tool. You can use this tool to wait upwards home values and sale prices of homes recently sold in your area.

- Federal Housing Finance Agency's HPI Calculator. This reckoner can help y'all understand how home prices are increasing or decreasing in your surface area.

- Homesnap. This search portal provides detailed listing data for homes across the state. It includes photos and in-depth information on property listings and sales history.

- Neighborhood Scout. While designed for existent estate investors, sellers can also find it useful for determining dwelling values. The site uses custom analytics to provide data on homes nationwide. (Annotation: You volition accept to pay a fee to access this one.)

- PropertyShark. PropertyShark has comprehensive listings information for residential properties in the New York City area.

Remember yous'll need to come up up with at least three homes that are similar to yours.

When you've come upward with estimates based on comps, be sure to check the trends in your local market.

Any fewer than that and you lot may not exist able to come up upwardly with a realistic range for your home's list toll.

Finally, when y'all've come up upwards with estimates based on comps, be sure to cheque the trends in your local market place. Are habitation prices trending up or down? How many homes are on the market and what's the boilerplate time spent on the market place? What's the foreclosure rate like in your area? Accept property taxes increased or decreased in the last few years?

All of these questions tin can yield clues to the temperature of the marketplace then you lot tin can price your abode accordingly.

Understanding home value

At that place are three types of home value you need to be familiar with every bit a seller:

- Appraised value: According to Investopedia, appraised value is a home'southward value as determined by a professional person appraiser at a given betoken in time. Appraised value is used by mortgage lenders during the underwriting process to make up one's mind how much a heir-apparent can borrow.

- Assessed value: Assessed values are used to determine how much property taxation is owed on a dwelling house. Assessed value is set up past a municipal or county revenue enhancement assessor, who evaluates the domicile's features and those of comparable backdrop to arrive at a valuation. It'due south usually a lower number than fair market value.

- Off-white market value: Off-white market value refers to how a dwelling house is valued when both the buyer and seller are reasonably knowledgeable almost the holding and neither is under whatsoever pressure level to buy or sell. Co-ordinate to Realtor.com, fair market value tends to be the truest measure of a home'due south value overall, since information technology's based primarily on supply and demand.

Key takeaways

The prospect of endmost the deal on a auction becomes much less intimidating when you lot're heading to market with a carefully researched valuation in your dorsum pocket. Remember, the goal is to sell your home at the right fourth dimension and the correct price according to your needs.

Rebecca Lake

This article is meant for informational purposes only and is not intended to exist construed every bit financial, revenue enhancement, legal, real estate, insurance, or investment advice. Opendoor e'er encourages you to attain out to an advisor regarding your ain situation.

Unlock an offering on your dwelling house

- Get a free, no-obligation offer in 24 hours.

- Skip the hassle of listings, showings, and repairs.

- Close on your own timeline.

Source: https://www.opendoor.com/w/guides/how-to-determine-home-value

0 Response to "How Do You Know Market Price of Home"

Post a Comment